Warning: Undefined array key "dirname" in /home/anapuafm/public_html/wp-content/themes/anapuafm/include/plugin/filosofo-image/filosofo-custom-image-sizes.php on line 133

Warning: Undefined array key "extension" in /home/anapuafm/public_html/wp-content/themes/anapuafm/include/plugin/filosofo-image/filosofo-custom-image-sizes.php on line 134

IFS warns of rising debt servicing cost

The Institute of Fiscal Studies (IFS) has raised concerns over the rising debt servicing costs in the country, warning of dire consequences on the economy if something is not done to halt it.

The policy tink tank believes the sharp increase in the country’s public debt over the last decade has had serious implications for economic growth, key among them being the high debt servicing cost which exposes the economy to the vicissitudes of external shocks.

This was disclosed by the Executive Director of IFS, Professor Newman Kusi, when he made a presentation on the country’s growing public debt and its implications for the economy at an event which was organised by the institute in Accra.

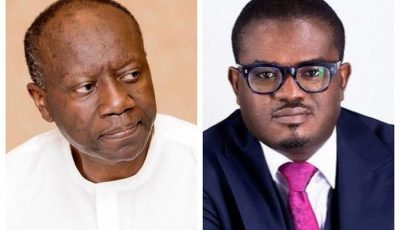

The programme which was chaired by the Chairman of the National Peace Council, Rev Professor Emmanuel Asante, had panellists such as the Chairman of the Finance Committee in Parliament, Dr Mark Assibey Yeboah, the Member of Parliament for Bolga Central, Mr Isaac Adongo, the immediate past Second Deputy Governor of the Bank of Ghana, Dr Johnson Assiama, the Executive Director of the Ghana Centre for Democratic Development (CDD), Professor Kwasi Prempeh, and the Founder of IFS and former Minister of Finance, Dr Kwabena Duffuor, who contributed to the topic under discussion.

Interest payment on public debts

Interest payment on the country’s public debt increased sharply from GH¢393.4 million in 2006 to GH¢679.1 million in 2008, GH¢2.4 billion in 2012, and then to GH¢10.7 billion in 2016.

Professor Kusi said this meant that the government paid a total of GH¢1.5 billion between 2006 and 2008 as interest on public debt, GH¢6.5 billion during 2009-2012 rising to GH¢31.5 billion between 2013 and 2016.

In 2017, he said a provisional amount of GH¢13.3 billion was recorded as interest payment on public debt and was projected to increase to GH¢14.9 billion this year.

He said this implied that by end-2018, total interest payment by the government on its debt since 2006 will be GH¢68.4 billion.

Percentage of govt expenditure

The executive director also pointed out that interest payment on public debt accounted for 8.5 per cent of total government expenditure in 2008, rising to 11.8 per cent in 2012, and then jumped to 21.1 per cent in 2016.

In 2017, he said interest payment accounted for 25.8 per cent of government expenditure, becoming a major factor behind the country’s fiscal deterioration, besides wages and salaries.

“Interest costs are now higher than domestic-financed capital expenditure and threatening to equal or even overtake wages and salaries if public borrowing is not slowed down,” he stated.

“In fact, 2017 was the fifth successive year that total interest payment was larger than total domestic-financed capital expenditure, suggesting that interest payments will probably be financed through additions to public debt or at the expense of other key government expenditures,” he added.

Percentage of total revenue

He also noted that as a percentage of total tax revenue, interest payment on public debt dropped from 16.9 per cent in 2006 to 15.8 per cent in 2008 but increased thereafter to an average of 20.2 per cent between 2009 and 2012 and 36.6 per cent during the 2013-2016 period.

“In 2017, interest payment on public debt was equal to 41.8 per cent of total tax revenue. This means that while in 2008, about 16 pesewas of each GH¢1.0 tax collected by the government was used to pay interest on its debt, by 2017 the figure had increased to 42 pesewas due to the astronomical increase in the public debt stock over the period,” he explained.

He said this suggested that resources had been taken away from several critical sectors of the economy, with serious negative implications for growth and poverty reduction.

Policy recommendations

Touching on some policy recommendations, Professor Kusi called on the government to adopt a comprehensive debt management strategy that puts caps on the levels of gross concessional and non-concessional borrowing.

He said limits should also be placed on contracting and/or guaranteeing non-concessional loans that could become liabilities to the government.

“To effectively monitor the public debt stance, strict measures and quantitative targets would have to be set to guide the efficient delivery of cash and debt management. In a world of large and volatile capital flows and integrated international capital markets, sound management of the public debt is an important element in safeguarding the country’s economic stability,” he noted.

Panel discussion

Dr Johnson Assiama, contributing to the panel discussion, described the situation as an age old problem which has been with the country.

“It’s a problem that has been with us for a long time and not new and this is due to the fact that we have not been mobilising adequate revenue to finance our expenditure,” he stated.

Professor Kwasi Prempeh, for his part, called for the need to look at the issue from a political economy perspective

He said the nature of politics in the country incentivises politicians to defer taking the hard measures needed to address the problems in the country.

“They decide to borrow instead of taxing which might be what is needed. They defer the taxing and rather borrow just to win political points,” he noted.

Dr Kwabena Duffuor also called for the need for each and every one to come together regardless of which political party to help fix the problem.

He said the issue of public debt should not be a political or divisive issue since it bordered on national importance.

Source: Graphic